Once viewed as a fringe movement, environmental stewardship has seen exponential growth in the past few years. We’ve seen a dramatic shift, with impact investing, purposeful prosperity and related philosophies gaining increasing traction.

There’s no shortage of jargon in the financial industry, but this one has garnered a lot of attention: ESG, investing in companies that are Environmentally friendly, Socially responsible and with Governance accountability. You’ve likely heard the acronym, but we thought that Earth Day (celebrated on April 22nd) offered a timely springboard for a deeper dive on this complex, potentially polarizing and often misunderstood topic.

Learn more about Mayflower’s impact investing solutions—as ESG goes mainstream and purpose and profits intersect.

Since its 1970 inception, annual April 22nd Earth Day celebrations have given “voice to an emerging public consciousness about the state of our planet.” Once viewed as a fringe college movement, this global organization is now recognized as a leading voice in ecological activism. Environmental stewardship has also seen exponential growth in the past few years, and the financial industry is no exception.

There’s no shortage of jargon in the financial industry, but this one has garnered a lot of attention: ESG, investing in companies that are Environmentally friendly, Socially responsible and with Governance accountability. You’ve likely heard the acronym, but we thought that Earth Day offered a timely springboard for a deeper dive on this complex, potentially polarizing and often misunderstood topic.

Until recently, these factors hadn’t been a primary concern for most individual investors or even corporate leadership. In fact, sustainability and social responsibility were previously considered to run counter to corporate profitability and investors’ interests.

“The Investor Revolution”:

ESG Goes Mainstream

We’ve seen a dramatic shift over the past few years, however. Impact investing, purposeful prosperity and related philosophies have gained traction and become mainstream. Some point to the events of this tumultuous last year as having spurred a lot of the interest and influx into these types of investments. No doubt, interest in this topic has certainly piqued, but that momentum was already building.

In this 2019 “The Investor Revolution ” Harvard Business Review article, the authors noted the disconnect between investors’ shifting priorities to focus on ESG strategies and business leaders’ outdated perception that it had not yet gone mainstream.

The authors interviewed 70 senior executives at 43 global institutional investing firms, including the world’s three biggest asset managers and a number of large domestic and international asset owners. They concluded that shareholders were getting serious about sustainability, demanding that corporate leaders be held accountable for ESG performance.

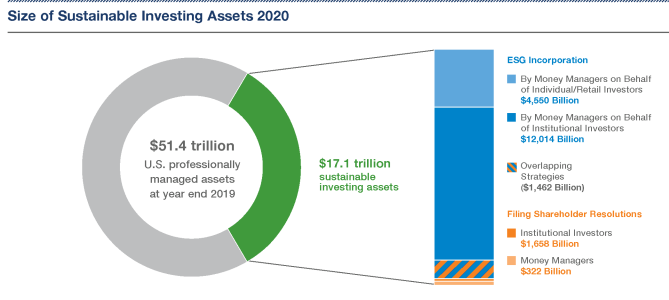

The numbers don’t lie (via The Forum for Sustainable and Responsible Investment):

- The net total of sustainable investing assets under management (AUM) at the beginning of 2020 was $17.1 trillion.

- This represents 33% of the $51.4 trillion in total U.S. AUM.

Sustainable investing has experienced exponential growth over the last few years, and many financial advisors, individual investors and institutional investors have begun to embrace the possibilities. PwC forecasts that by 2025, ESG will increasingly be accepted in the U.S. “due to rapidly increasing client demand and regulatory influence.” ESG and sustainable investing can also be referred to as Socially Responsible Investing or Impact Investing. With all of the acronyms and pseudonyms, it can all get a bit confusing. While this investment discipline has gained a lot of attention, there is still a lot of confusion and some persistent performance myths.

Let’s take a closer look at the facts:

- What ESG Investing Is—and Is Not

- Brief History

- By the Numbers

- Investment Performance

What ESG Is—and Is Not

Sustainable, aka socially responsible, investing is a strategy that considers and weighs environmental, social, and governance (ESG) factors while also identifying opportunities for strong financial results. As with any other investment discipline as investors you need to establish your goals and weigh the potential benefits of the various approaches against risk and cost relative to those goals.

ENVIRONMENTAL factors may include:

ENVIRONMENTAL factors may include:

* climate change

* green buildings

* cleaning up pollution

* water use

* conservation

SOCIAL factors may include:

* employee safety & well-being

* labor relations

* avoidance of tobacco/alcohol

* product liability

* strong diversity & equity doctrines

GOVERNANCE factors may include:

* corporate political contributions

* board diversity

* executive compensation

Simply put, there’s neither a singular definition nor criteria to distinguish this approach: “ESG investing is an investment-related activity that accounts for some type of ESG consideration. It is not a separate asset class, a single strategy, or even a single type of action, and importantly, the appropriate approach is not the same for all investors” (Vanguard).

Brief History

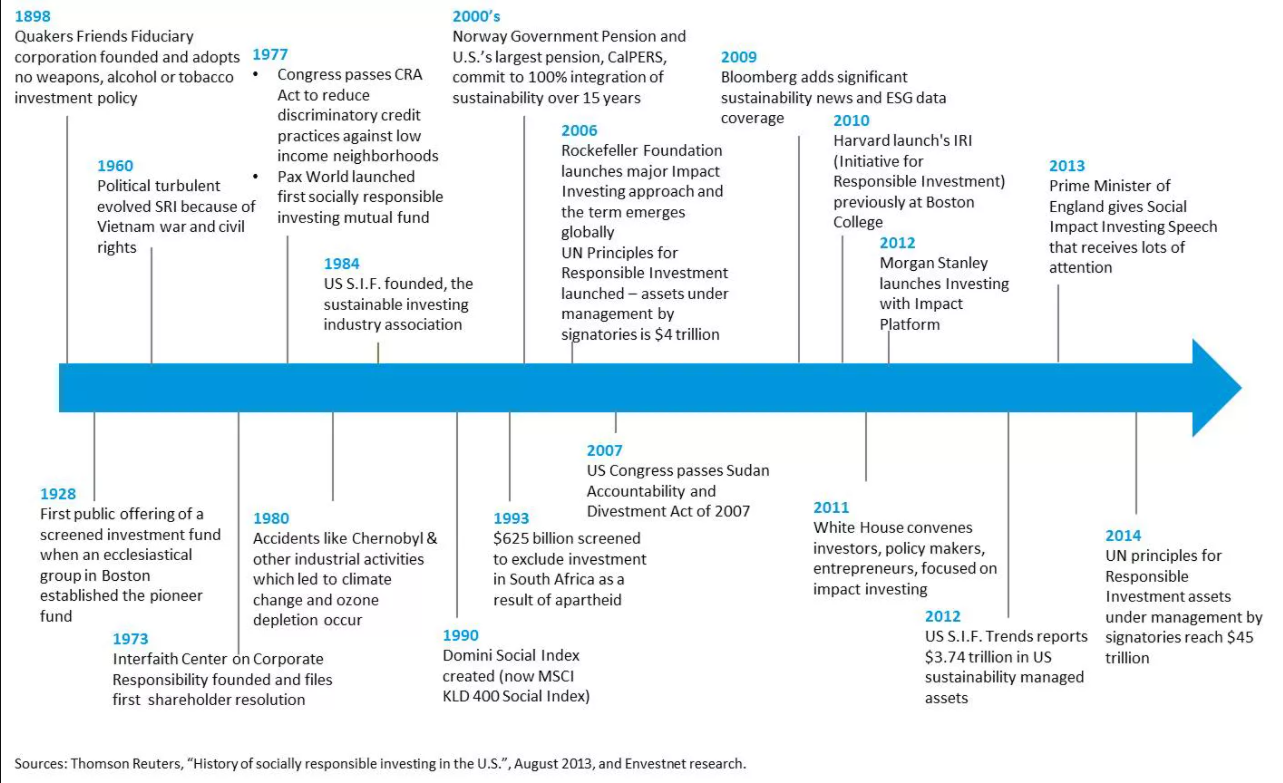

While impact investing has received a lot of press lately, applying sustainable principles to money matters is not a new concept. In fact, sustainable investing can be traced back to some of the earliest foundations of the three prophetic religions. In Judaism, Christianity and Islam, followers are encouraged to weigh moral beliefs in all their money practices, and related guidelines were enforced to prevent exploitation and harm.

In the U.S., there are many historical moments when socially responsible investing surged in popularity:

- In the 1700s, a group of Quakers, who champion pacifism, forbid investments in slavery and war.

- In the 1800s, another group of Protestant Christians actively avoided investing in companies manufacturing and/or offering certain undesirable goods and services. John Wesley, in his sermon “The Use of Money ,” specifically spoke out against investing in “sin” stocks—guns, liquor, tobacco, gambling, etc.—asserting, “We ought to gain all we can gain but this it is certain we ought not to do; we ought not to gain money at the expense of life, nor at the expense of our health.”

- In 1928, a group in Boston founded the first publicly offered fund, the Pioneer Fund, which had similar restrictions—avoiding what they called also “sin” industries.

- The 1960s saw a resurgence of socially responsible investing when Vietnam Conflict protestors demanded that university endowment funds no longer invest in defense contractors. This action spotlighted how corporate profits were earned at the expense of certain groups of people and/or the environment.

- In the 1980s, many institutions and companies avoided investments in South Africa as a way of protesting apartheid.

By the Numbers

Since 1995, when the “US SIF Foundation” first measured the size of the U.S. sustainable investments at $639 billion, assets have increased more than 25-fold, a compound annual growth rate of 14%.

Since 1995, when the “US SIF Foundation” first measured the size of the U.S. sustainable investments at $639 billion, assets have increased more than 25-fold, a compound annual growth rate of 14%.

U.S. assets managed within ESG or impact strategies were roughly $12 trillion in 2018—up 38% from 2016 and 4X greater than they were in 2010. The net total of sustainable investing AUM at the beginning of 2020 was $17.1 trillion, representing 33%, or one in three dollars, of the $51.4 trillion in total U.S. AUM.

According to Morningstar’s “Sustainable Funds U.S. Landscape Report“:

- The number of sustainable open-end and exchange-traded funds available to U.S. investors increased to 392 in 2020, up 30% from 2019.

- This group has experienced a nearly fourfold increase over the past 10 years, with significant growth beginning in 2015.

- In 2020, 71 sustainable funds were launched, easily topping the previous high-water mark of 44 set in 2017.

- At least 30 funds have been launched each year from 2016 to 2020.

With that backdrop, Part 2 explores investment performance, the intersection of profits and purpose and Mayflower’s ESG investment solutions. Continue reading “ESG, Sustainability & Profit”…

This content is gathered from sources believed to be credible and informational in nature and not intended as individualized financial, legal or tax advice. Wealth management and financial planning decisions are complex and fluid and should be structured around each client’s unique situation and needs. Parties should carefully consider all related benefits, risks and costs and speak to their trusted advisors before making any significant decisions.

As with any other form of investing, investors must establish their goals and weigh the potential benefits of the various approaches against any relevant risks and costs to give themselves the best chance of achieving their desired outcomes. The SEC recently put out an Investor Bulletin to provide investors with specific information related to ESG Funds, including important questions to ask if considering investing in them. The SEC reminds all investors that is important to understand what you are investing in, and to be sure a fund (or any other investment) will help you achieve your investment goals. Investors should also consider whether a fund’s stated approach to ESG matches individual goals, objectives, risk tolerance and preferences.