Just because someone calls themselves an advisor and maybe even has several official-looking letters following his or her name does not necessarily mean that they are committed to your best interests. This month’s Mayflower Minute explores the roles and obligations of fiduciaries. Thankfully, the SEC has strict rules and regulations governing advisory firms, and Registered Investment Advisors (RIAs)—like Mayflower Advisors—“must, at all times, serve the best interest of its client and not subordinate its client’s interest to its own.”

Managing Partner Larry Glazer noted, “As an independent RIA, we can sit on the same side of the table along with our clients, just like we have for three generations of valued relationships.” Learn more about the fiduciary standard and its impact on wealth stewardship.

Understanding the differences between the myriad types of “financial advisors”—a closer look at wealth management’s acronym alphabet soup, fiduciaries vs. non-fiduciaries and what to consider when you’re looking for an advisor.

The Fiduciary Standard:

Who You Trust With Your Hard-Earned Wealth Matters

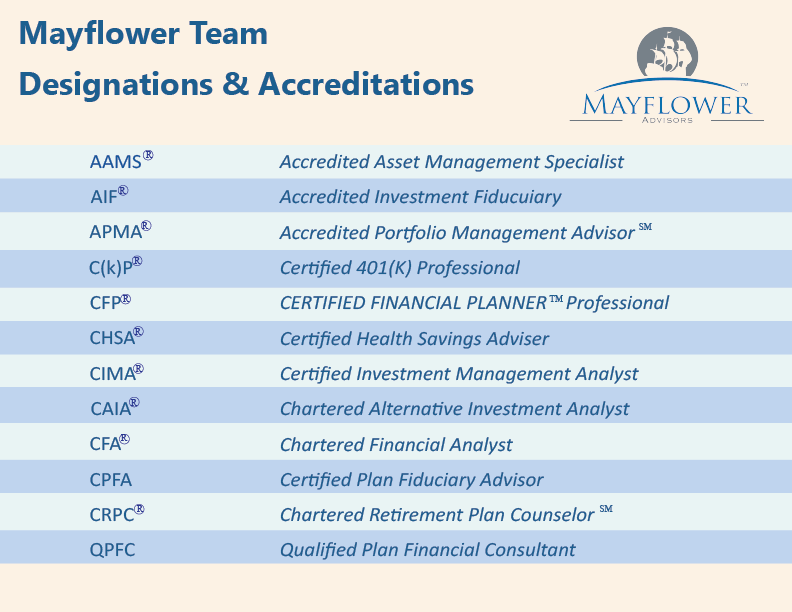

“The financial advice industry has 212 reasons to be confused,” muses a recent article in Financial Planner: “That’s the bewildering number of professional designations advisors use to indicate their expertise in every money issue under the sun, from retirement planning and college savings to insurance and investment funds.” From AAMS® (Accredited Asset Management Specialist?) to WMS? (Wealth Management Specialist?) and the other 210 acronyms in between, that number is up from professional and accredited 184 designations three years ago (Source: The Financial Industry Regulatory Authority [FINRA]).

These designations are certainly important, and we’re proud to note more than 25 wide-ranging designations among Mayflower’s team, including—among others:

But just because someone calls themselves an advisor and maybe even has several official-looking letters following his or her name does not necessarily mean that they are committed to your best interests. “Anyone can call themselves a ‘financial planner’ or ‘wealth advisor,’” the same Financial Planner write-up cautions.

Let’s take a look at how to distinguish between all of these different types of wealth managers when you are looking to invest and find a steward for your hard-earned wealth. More specifically, we’ll look at the roles and obligations of fiduciaries—advisors who have a legal obligation to act in their clients’ best interests.

A Brief History of the Fiduciary Rule

Prior to 2016, outside of the financial world, most people probably had never even heard the term fiduciary. The term has been documented since at least the late 16th century. According to Oxford Languages, at that time, it began appearing and meant in the sense “something inspiring trust; credentials,” from the Latin fiduciarius, from fiducia “trust,” from fidere “to trust.”

Today, “A fiduciary is a person or organization that acts on behalf of a person or persons, and is legally bound to act solely in their best interests” (Source: Investopedia).

Employee Retirement Income Security Act of 1974 (ERISA)

ERISA regulations issued in 1975 defined investment advice using a five-part test. To be held to ERISA’s fiduciary standard with respect to his or her advice, an individual had to do all of the following:

(1) Make recommendations on investing in, purchasing, or selling securities or other property, or give advice as to the value

* On a regular basis

* Pursuant to a mutual understanding that the advice

(2) Serve as a primary basis for investment decisions

(3) Be individualized to the particular needs of the plan regarding such matters as, among other things, investment policies or strategy, overall portfolio composition or diversification of plan investments

2016 Fiduciary Rule

In 2016, the Department of Labor (DOL) issued an updated final regulation that redefined the term investment advice within pension and retirement plans. The 2016 Fiduciary Rule was intended to update the 1975 rules, which had enabled many investment professionals to operate outside fiduciary standards, and expanded the definition of investment advice fiduciary under ERISA.

The 2016 rule was officially vacated by the Fifth Circuit Court of Appeals in 2018, but resurfaced in a less restrictive form in 2020. Notably, the latest version was approved by President Biden’s administration and went into effect in February 2021. (Source: U.S. News & World Report)

The 2016 rule was officially vacated by the Fifth Circuit Court of Appeals in 2018, but resurfaced in a less restrictive form in 2020. Notably, the latest version was approved by President Biden’s administration and went into effect in February 2021. (Source: U.S. News & World Report)

In simple terms, the DOL’s updated definition of fiduciary, especially as related to retirement planning, IRAs (individual retirement accounts) and 401(k)s, requires that fiduciary advisors act in the best interests of their clients and put their clients’ interests above their own. They need to be transparent about any potential conflicts of interest, fees and commissions for retirement plans and retirement planning advice must be clearly disclosed. (Source: “Department of Labor’s 2016 Fiduciary Rule”)

What Makes a Fiduciary Different from Other Financial Advisors?

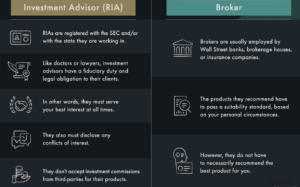

A recent article in U.S. News & World Report provides a helpful breakdown of explaining the differences between a fiduciary and financial advisor:

A financial advisor is a job description, which can include fiduciary and non-fiduciary advisors. A fiduciary is any professional who is upheld to a fiduciary standard—meaning the person must act in your best interest—and can include financial advisors, attorneys, guardians and other professionals.

Fiduciary Duty Is the Highest Standard of Care

According to the Cornell Law Dictionary, “A fiduciary duty is the highest standard of care.” It entails always acting in your beneficiary’s best interest, even if doing so is contrary to yours. For a financial advisor, this may mean recommending a product that results in reduced or no compensation because it’s the best option for the client.

A fiduciary is required to disclose any conflicts of interest that arise and resolve them in the client’s favor, and will avoid using client’s assets in any way for their own benefit.

The SEC has strict rules and regulations governing advisory firms, and by law, Registered Investment Advisors (RIAs)—like Mayflower Advisors—must be fiduciaries. Managing Partner Larry Glazer noted: “Mayflower’s new world approach to financial stewardship is proudly anchored in the fiduciary standard—our first and only priority is honoring that commitment to our clients. I often tell people that there are many conflicts and people claiming to be independent in the financial services industry.”

According to the SEC, as a fiduciary, an RIA “must, at all times, serve the best interest of its client and not subordinate its client’s interest to its own.” Alternatively, other advisors, such as broker-dealers, are held to a different standard or a suitability obligation, meaning while they must provide suitable recommendations to their clients, they don’t have to put their clients’ interests before their own.

Glazer continued, “Our clients appreciate that we are truly independent, representing only their interests—not those of a big Wall Street firm. As an independent RIA, we can sit on the same side of the table along with our clients, just like we have for three generations of valued relationships.”

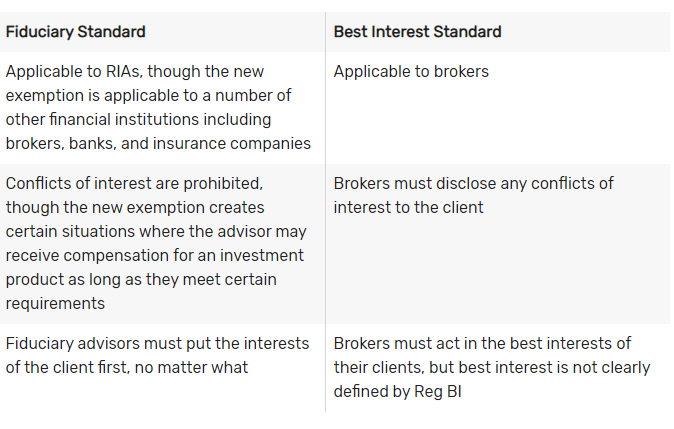

In June 2019, the SEC introduced Regulation Best Interest (Reg BI) to hold non-fiduciary advisors to higher standards than they were previously subject to. Reg BI Guidelines are closer to the fiduciary level but is still not as stringent. You can see the differences in the chart below.

Fiduciary Rule vs. Regulation Best Interest

Further complicating matters, however, in February 2021, the DOL expanded the definition of fiduciary advice to include investment advice regarding rollovers from retirement plans like 401(k)s and advice pertaining to IRAs for RIAs, broker-dealers, banks and insurance companies.

It now also allows such advisors to receive compensation such as commissions (which was previously prohibited). (Source: “Fiduciary Investment Advice: Implications Of Department Of Labor Prohibited Transaction Exception 2020-02”)

Bottom Line for Investors

As we said at the outset, it can be mind-bending to try to understand all of the financial designations out there, the legal obligations and the rules around how they are—or are not—required to conduct themselves when handling their clients’ money.

Alarmingly, a 2019 Financial Trust Report found that nearly half of Americans mistakenly believe all advisors are legally required to always act in their clients’ best interests. It also revealed that 65% of investors who work with a financial advisor incorrectly believe that financial advisors only make recommendations that are in a client’s best interest, an increase from 46% in 2017.

Alarmingly, a 2019 Financial Trust Report found that nearly half of Americans mistakenly believe all advisors are legally required to always act in their clients’ best interests. It also revealed that 65% of investors who work with a financial advisor incorrectly believe that financial advisors only make recommendations that are in a client’s best interest, an increase from 46% in 2017.

Clearly, there is a lot of confusion around what the roles and obligations of financial advisors are. As an investor, you want to make sure you do your homework when it comes to working with any potential advisors. You’ll want to ensure that you understand at a minimum exactly who you are working with, what they are going to do for you and what the costs will be. Or, as Ronald Reagan advised, “Trust, but verify.”

We’ve included a number of investor resources from FINRA and investor.org below (to inform some of the questions you should ask) in addition to databases that can provide additional information. As always, be sure to work closely with your own wealth manager to discuss your unique circumstances and to learn more about how we adhere to our fiduciary obligations.

Additional Helpful Resources

How to Select an Investment Professional: This updated Investor Bulletin provides a few key tips to help you make a well-informed choice.

Questions to Ask when Hiring an Investment Professional: This Investor Bulletin provides you with questions you should ask before hiring any investment professional, including about experience and background, products offered, payments and fees and expectations of the relationship.

Selecting Your Investment Professional: Before you engage an investment professional, make sure you know more than just their name and professional credentials.

How to Find and Work With an Investment Professional: Six steps to help you find, and successfully work with, an investment professional.

NAPFA.org (The National Association of Personal Financial Advisors)

Visit napfa.org to check their database.

SEC (U.S. Securities and Exchange Commission) Adviser Database

Visit Investment Adviser Public Disclosure for SEC’s advisor search tool.

FINRA Registration Check

You can search FINRA BrokerCheck here.

This content is gathered from sources believed to be credible and informational in nature and not intended as individualized financial, legal or tax advice. Wealth management and financial planning decisions are complex and fluid and should be structured around each client’s unique situation and needs. Parties should carefully consider all related benefits, risks and costs and speak to their trusted advisors before making any significant decisions.